Naples, 20 May 2024 – Next Geosolutions Europe S.p.A, a leading international company in the field of marine geosciences and offshore construction support services mainly in the energy sector, with a focus on renewable energies, (“NextGeo” or the “Company”), announces that, today, Borsa Italiana S.p.A. has arranged for the admission to listing of NextGeo’s ordinary shares on the Euronext Growth Milan market (“EGM”), managed and organised by Borsa Italiana.

Attilio Ievoli, President of NextGeo and CEO of Marnavi Group: “Today we reach a very important milestone for our company that marks a new course: the success of this transaction confirms the effectiveness of our strategy and we are ready to face this new growth opportunity with determination. The listing on the stock exchange allows us to raise the necessary capital to consolidate our position among the market leaders and to finance innovative projects that will allow us to be more and more competitive globally”.

Giovanni Ranieri, CEO of NextGeo, commented: “We are excited and proud to welcome the positive outcome of the IPO. Over the last few years we have been able to seize all the opportunities offered by a highly dynamic market, making us key players in continuous growth and leading us to attain a prominent position in our sector. The capital raised will be used to grow further and to develop cutting-edge technological solutions, useful to respond to the needs of a constantly evolving sector such as that of renewables, as well as to increase our fleet of ships and to think for the near future of a possible geographical expansion of the business also through M&A operations”.

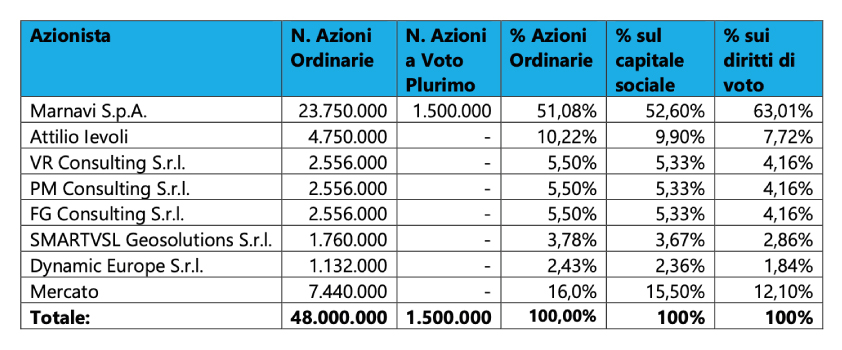

The total amount of the placement (the “Placement“) reserved to primary institutional investors and qualified investors, both Italian and foreign, is equal to € 57,500,000, (of which € 50,000,000 in capital increase and € 7,500,000 deriving from the exercise of the overallotment option granted by the shareholders Dynamic Europe S.r.l., VR Consulting S.r.l., FG Consulting S.r.l., PM Consulting S.r.l. (“Shareholders“). The placement concerned 9,200,000 shares, of which 8,000,000 newly issued from the capital increase aimed at admission to the EGM and 1,200,000 from the exercise of the overallotment option, at a price set at € 6.25 per share. It should be noted that the Issuer’s share capital is made up of 48,000,000 shares, of which 46,500,000 are ordinary shares admitted to trading and 1,500,000 are shares with multiple voting rights, the latter held by the shareholder Marnavi S.p.A. The Company’s expected capitalisation on the first day of listing is € 290,625,000, based on the number of ordinary shares admitted to trading (€ 300,000,000 including the 1,500,000 multi-voting shares not admitted to trading), with a free float of 13.42% if the greenshoe option granted by the Shareholders is not exercised, rising to 16.00% if the greenshoe option is fully exercised.

Below is the composition of the Company’s share capital assuming the full exercise of the greenshoe option:

The Company, the shareholders Marnavi S.p.A., Attilio Ievoli, Dynamic Europe S.r.l. (headed by Attilio Ievoli), VR Consulting S.r.l. (headed by Giovanni Ranieri), FG Consulting S.r.l. (headed by Fabio Galeotti), PM Consulting S.r.l. (headed by Giuseppe Maffia), representing 100% of the Issuer’s share capital prior to Admission, and the Cornerstone investor SMARTVSL Geosolutions S.r.l. have undertaken lock-up commitments for a period of 12 months starting from the date of commencement of trading of the shares on Euronext Growth Milan.

The trading start date is set for 22 May 2024. The ordinary shares have been assigned the following ISIN (International Security Identification Number) IT0005594418 code, with ticker NXT.

***

In the listing process, NextGeo was assisted by Intesa Sanpaolo S.p.A., as Global Coordinator, Specialist and Joint Bookrunner, Alantra Capital Markets as Euronext Growth Advisor and Joint Bookrunner, by Ceresio Investors as Lead Manager, by IPOCoach as Financial Advisor, by PricewaterhouseCoopers S.p.A., as Auditor, Financial DD and Management Control System, by Chiomenti as legal advisor, by Cleary Gottlieb Steen & Hamilton LLP as legal advisor to the banks, by Studio Cerrito as Payroll DD, by RSM Società di Revisione e Organizzazione Contabile S.p.A. as financial & tax due diligence advisor, and by CDR Communication as Advisor of the Company in matters of Investor Relations and the Company’s Press Office.

***

The admission document and this press release are available at the registered office of the company and in the investor section of the website https://www.nextgeo.eu/. Please also note that, for the dissemination of regulated information, the company uses the eMarket SDIR circuit managed by Teleborsa S.r.l.

This press release also constitutes a communication pursuant to article 6 of Delegated Regulation (EU) 2016/1052. Alantra Capital Markets Sociedad De Valores S.A.U. – Italian Branch reserves the right to carry out stabilisation activities on the shares in compliance with the regulations in force. Such activity may be carried out from the date of commencement of trading of the shares and until 30 days after such date. There is, however, no certainty that stabilisation activity will actually be carried out; it may be interrupted at any time. Stabilisation transactions, if undertaken, could result in a market price that is higher than the price that would otherwise arise. Stabilisation transactions are intended to support the market price of the shares during the stabilisation period and will take place on Euronext Growth Milan.